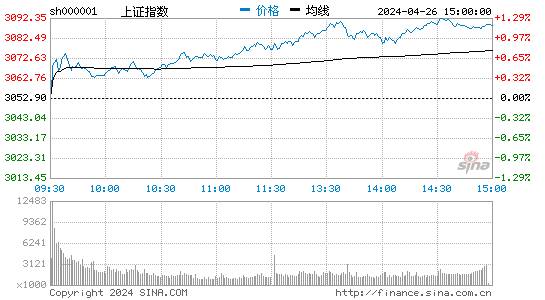

Stock Market News: Shanghai Stock Index Fell 0.9%; CPI Data Suppresses Bull Sentiment

Comments: Shanghai Index fell 0.9% CPI data suppressed bulls' sentiment

Today, the two cities opened slightly lower

Market situation

Today, the highway and bridge sector bucked the trend of general growth. Longjiang Transportation [2.90 9.85% stock bar research report] rose by the limit, Jilin Expressway [2.85 9.62% stock bar research report] rose by more than 9%, Zhongyuan Expressway [2.66 2.70% stock bar research report], Sichuan Chengdu Chongqing [3.74 1.36% stock bar research report], Shandong Expressway [3.67 0.82% stock bar research report], and Wantong Expressway [4.57 1.56% stock bar research report] all rose by more than 2%, The whole plate is red. On the message side,

Today, the rare-earth permanent magnet sector rose across the board, with the leading Guangsheng Nonferrous [65.37 2.20% share bar research report] up more than 5%, NFC [22.94 0.04% share bar research report], Tibet Development [21.03 -1.36% share bar research report], Beikuang Magnetic [15.09 -1.11% share bar research report], Minmetals Development [26.07 -0.69% share bar research report], and Hengdian Dongci [17.05 -2.52% share bar research report] all up more than 1%. At a time when the US, Europe and Japan's lawsuit against China's [2.28 2.24%] export of rare earth is pending, the rare earth industry is quietly ushering in multiple benefits. It was reported that the China Rare Earth Industry Association, which had been brewing for four or five years, was officially listed on April 8. The data shows that the prices of most varieties of rare earths reappeared significantly last week after stabilizing in the middle of last month.

In the morning, the cement sector rose rapidly, with Sichuan Shuangma [8.61 5.39% share bar research report] up more than 8%, Tongli Cement [11.19 1.63% share bar research report], Tapai Group [9.48 0.85% share bar research report], and Huaxin Cement [14.43 2.41% share bar research report] all up more than 3%. On the news side, at the "Seminar on the Development of China's Cement related Industries and Innovation of Cement Marketing Mode" held by the China Cement Association on April 8, the source said that the revision of the nitrogen oxide emission standard for cement enterprises has been officially approved, and the new standard will not be more stringent than the current international strictest 500 mg/standard cubic meter, Cement enterprises participating in emission reduction will receive financial subsidies.

On the news side, recently, the prices of two products, namely, arowana oil and peanut oil, have been adjusted by about 8% since the end of March. The rise in the price of edible oil has indeed played a real role for grain and oil companies with very low gross profit margins. On the secondary market, Dongling Cereals and Oils [15.41 0.00% share bar research report] and Xiwang Food [27.61 5.58% share bar research report] once rose more than 5% in the morning. Brokers said that this price adjustment will take a certain period of time from production enterprises to distribution channels, wholesalers and terminal stores, and is expected to be about three to four weeks. At the same time, the recent price of soybeans and soybean meal has risen significantly, and related concept stocks may continue to rise.

Policy

The CBRC requires banks to charge fees in strict accordance with the catalog from April, and no fees shall be charged for items not publicized. Regulations will be issued to restrict bank service charges; The State Council plans to establish regulations to eliminate the profit making space of security housing; The Ministry of Industry and Information Technology released the 12th Five Year Development Plan for software and information technology service industry; The NDRC deploys eight tasks for economic operation; Beijing, Tianjin, Shenzhen, Nanjing, Guangzhou and other five cities applied for the pilot of replacing business tax with value-added tax; Various regions have successively formulated the scheme of tiered tariff collection, which is expected to be launched in the second quarter; The Ministry of Land and Resources said that the 12th Five Year Plan will vigorously foster emerging marine industries; National rare earth industry association was established; The conference on business innovation of securities companies will be held soon; Shanghai and other three cities carried out pilot methanol automobile industry.

Message side

The March economic data was released today, and the market expected CPI to reach 3.5%; It is reported that the manager of Guangdong pension has been determined and the investment plan is mainly stock; Central bank tickets have been suspended for 13 consecutive weeks; The new third board will be launched in the third quarter as soon as possible; Restricted shares in two markets this week

- Related reading

- market research | Market Observation: Data Analysis On The Adjustment Trend Of Cotton Price Shocks In The Domestic Market Affected By The Environment

- I want to break the news. | The 30Th FASHION SOURCE Shenzhen Exhibition

- Finance and economics topics | Financial Report Shows The 2024 Annual Performance Of The Five Top Sports Apparel Listed Companies

- Wealth story | Hangzhou Customs Does "Foot" Work To Improve The Quality And Development Of "International Socks City"

- Successful case | "Grassroots Industry" Weaves "Small Silk Thread" Chain To Strengthen "Big Industry"

- Commercial treasure | The Accumulated Advantages Of Jiangsu Textile Leave Time And Space For Transformation

- Business School | Textile Industry Accelerates From Volume To Quality And Efficiency

- Market prospect | Market Analysis: Cotton In ICE Period Rose Sharply Before The US Tariff Policy Was Announced

- Men's district | [New Product Release] Zhimei, A Chinese Embroidery Talent

- Design Frontiers | Finalists Of The 14Th "Big Wave Cup" China Women'S Wear Design Competition

- Comparison Between Sports Brand Lining And Nike

- Listed Companies Are Now Laying Off Workers: Home Appliances, Textiles And Other Industries Become The Worst Hit Areas.

- Guo Weiqing: Middle Income Is A Pie &Nbsp, Or A Trap?

- Zhu Hai: Why Is China'S Happiness Index Lower Than Russia And India?

- Sandals Appeared In The First Half Of The Month In &Nbsp; The Average Price Was 20% Higher Than Last Year.

- Europe'S Currency Fell &Nbsp, And The US Dollar Gained Strength.

- Global Financial Markets A Big Theme On Friday

- Sports Brand Endorsement: Grassroots Marketing Strategy

- China's Banking Industry Is Facing Credit Risk.

- BOC Cashmere Industry Profits Surged 202.66%